Explaining the AI Market Bubble

What is a market bubble?

A market bubble is a self-reinforcing surge in asset prices where valuation becomes detached from the economic fundamentals that justify the price. For example, stocks or other assets may climb because investors believe they will continue to rise, not because of earnings or business models.

How does it happen?

- Displacement or shock: A new technology or macro shift draws in fresh capital. (Like Artificial Intelligence)

- Boom: Early investors profit, media attention grows, more buyers join.

- Euphoria: “This time is different” dominates; buying accelerates regardless of fundamentals.

- Distortion: Prices far exceed reasonable value; sentiment drives decisions more than data.

- Burst: A trigger reverses sentiment; prices fall quickly, often painfully.

Why does it occur?

- Herd behavior: FOMO and groupthink override independent valuation.

- Speculation: Rising prices drive more buying, not earnings or yield.

- Cheap money: Low interest rates or ample credit can fuel speculative booms.

- Media and hype: Narratives reinforce cycles; “this time it’s different” becomes common.

Current Focus: The AI Market Bubble

- The AI sector has seen explosive investment and valuation growth, often based on anticipated future returns rather than current earnings. This created the so-called AI market bubble

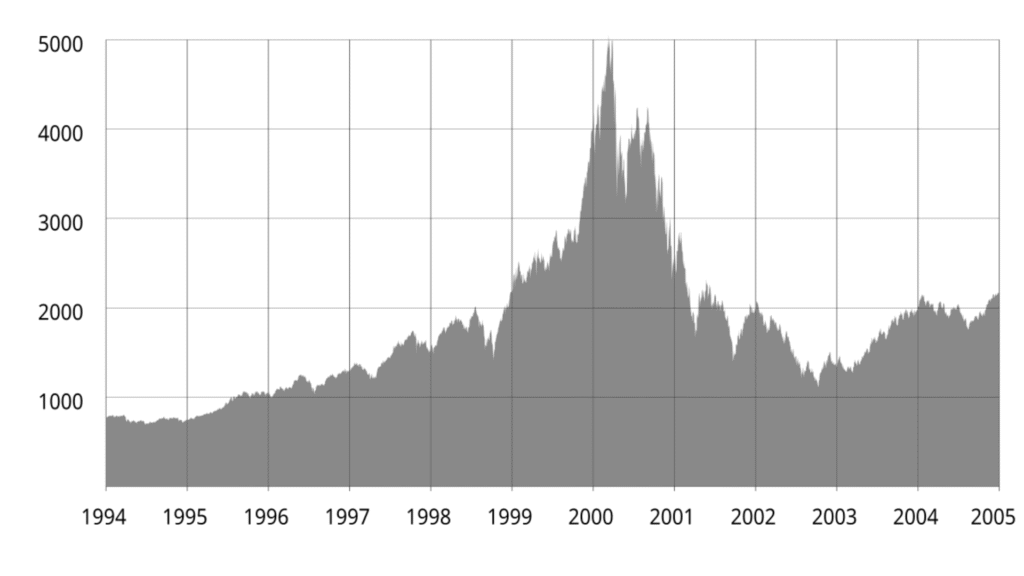

- Analysts warn of signs similar to the dot-com bubble: extreme valuations, intense media hype, and FOMO-driven capital flows.

- Major infrastructure investments, such as data centers and chips, have fed the cycle — with unclear short-term returns.

- Companies with minor AI exposure have seen outsized stock gains just from branding or market narrative.

Why it matters

- If the AI market bubble bursts, it can lead to sharp investor losses and distortions in capital allocation.

- In the AI case, a crash could impact not only markets but innovation, hiring, and broader tech ecosystems.

- Understanding market bubbles helps investors assess risk and avoid buying at euphoric peaks.

FAQ

- Can I avoid bubbles? Not entirely, but you can recognize warning signs and diversify to limit exposure.

- Are bubbles always destructive? Not necessarily — some innovations survive and thrive after correction.

- What are key warning signs? Rapid price growth with weak fundamentals, “greater fool” logic, and intense media hype.